Stockholm-based VC Creandum invests in its portfolio company lemon.markets, German developer of trading software in a 15 million-euro seed round led by Swiss VC&PE Lakestar and California-based Lightspeed Venture Partners. The round saw participation from System.one and many angel investors alongside Creandum. The funding will enable the company to launch its stock trading API for developers. It will also help it enlarge its regulatory knowledge team to accelerate its growth.

About Creandum

Creandum is a leading European early-stage venture capital firm backing some of Europe’s most successful tech companies including Spotify, iZettle, Depop, Klarna, KRY, Epidemic Sound and Small Giant Games. Creandum has offices in Stockholm, Berlin, London, and San Francisco.

About lemon.markets

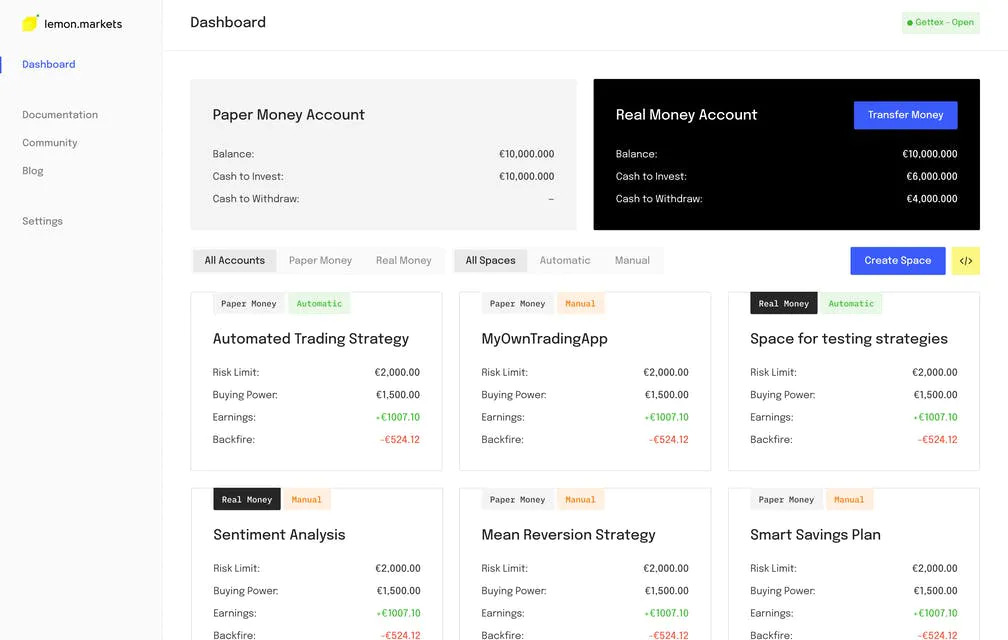

German startup enables developers to build their own investment and trading tools for the stock market. It provides the infrastructure to build your own project to manage your assets with your own software. The company envisions a future where securities trading can be implemented easily and quickly in any context.

“European brokerage is ripe for disruption. Every tech company should be able to embed financial services into their offering and lemon.markets wants to facilitate this. The demand is already there. Our infrastructure solution takes care of all the plumbing, so developers in these companies can dedicate their focus on creating value for users. We can’t wait to see the many different ways our API will be applied.” says Max Linden, co-founder and CEO of lemon.markets.

“The platform is providing tech companies the technical and regulatory infrastructure to integrate brokerage in their products – all through a single API. With companies facing increasing regulatory, compliance and structural hurdles, lemon.markets abstracts these complexities away for their customers through technology.” states Nicolas Brand, partner at Lakestar.

“The startup’s bottom-up developer focused go-to-market strategy allows it to partner with the best developers and companies building innovative and best in class products in the brokerage and securities trading space. An important part of their offering will be to scale those infrastructure products throughout Europe, setting the foundations for the next era of financial services across the continent.” says Justin Overdorff, partner at Lightspeed Venture Partners.

Click here to read more investors news.

Read MoreInvestors – ArcticStartup